USA Ph 813-391-0302

SJToner@SaundersRealEstate.com

Tampa Bay, Florida USA 33607

www.SaundersRealEstate.com

www.SRDcommercial.com

Land for Manufacturing / Warehouse / Office Properties

The Tampa Bay area was founded on international shipping, originally by sea, and then rail, roadways and air. Today it is no small part of the Tampa Bay business community. The land for this market; office/warehouse and manufacturing, continues to be a great asset to facilitate this critical and growing need.

In fact, the Tampa Bay-Orlando I-4 corridor is now home to Florida's largest concentration of distribution centers and is the 10th largest economic region in the US with a GDP of more than $302.6 Billion!

Benefits to Purchasing Land

Land can be leased (not purchased) on the properties of the Ports and Airports; including in areas designated as Free Trade Zones (FTZ's). The many benefits of purchasing land, however, can only be achieved on private property, which can also be designated as Free Trade Zones - FTZ's! In purchasing the land, the owner enjoys the benefits of value appreciation, legal control, freedom of construction, total access, and the capital gains of the eventual sale, as well as the complete tax and regulatory benefits of the FTZ status.

Add to these financial advantages the fact that shippers can save an average of $1,000 per truckload over the more traditional routes used to reach the Tampa Bay /Orlando 1-4 corridor, when they ship through Port Tampa Bay or nearby Port of Manatee.

Benefits in the Rural County Areas

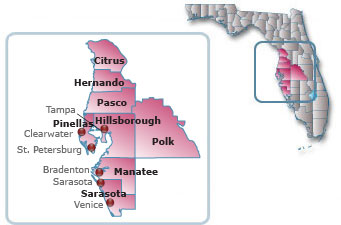

In fact, an investor can consider any land zoned for commercial or industrial use in Manatee, Sarasota, Pinellas, Hillsborough and Polk Counties for their FTZ property. The process to secure the FTZ status is a matter of filing with the FTZ Authority in the Tampa Bay area, which can get approved in Washington, DC approximately ten months later. This land can be in close proximity to the Ports and Airports, or out in the rural areas (where the price of rural land may offer significant savings) off an interstate access ramp for easy access to the various shipping options; air, ports, rail or truck.

These are five of the largest counties in the state by population and land mass; Manatee, Sarasota, Pinellas, Pasco and Hillsborough, which alone offers 1,266 square miles (3,279 km²). Polk County comprises 2,010 square miles (5,206 km²). There are numerous land parcels zoned for office / warehouse / industrial areas that have excellent access to rail systems, and interstate highway to the Ports, Airports, and the rest of North America without hitting a single stoplight!

Foreign Trade Zones (FTZ) are authorized real estate grounds and facilities to accommodate international traders and manufacturers. They are designed to encourage business development by saving the participants' duties in the movement of their goods in and out of the country. Specifically, Foreign Trade Zones offer significant tax advantages to importers and exporters.

The Foreign Trade Zones in the Tampa Bay area offers a unique advantage of using virtually any office/warehouse/industrial zoned real estate to become certified as an FTZ. This provides the potential for incredible savings, as the properties throughout the five county area provide competitive pricing!

The Business Benefits of these Foreign Trade Zones include:

- Duty deferral, reduction or elimination

- No formal customs entries

- No quota restrictions

- Goods delivered directly

- Reduced federal excise taxes

- Zone-to-zone transfer.

We present these properties and provide clients with the real estate brokerage services to purchase or lease such facilities in Tampa Bay, Florida, along with business development counsel on the unique aspects of this type of international transaction. Moreover, Tampa Bay provides a comprehensive inter-modal transportation system of sea shipping, air, rail and truck via interstate highways.

________________________________________

Foreign Trade Zones - by Definition

By definition, a foreign-trade zone is a secured area located within the United States, but technically considered to be outside the territory of U.S. Customs. Therefore, foreign-trade zones offer the ability to defer, reduce or even eliminate Customs duties on products, resulting in tremendous savings for your business.

For example, while imported goods are stored, assembled or manufactured in a foreign-trade zone, no duty is due. When the finished goods are entered into Customs territory, duty is paid only on the goods entered, not on materials or parts used in production. Additionally, users of a zone do not have to pay duty on goods processed and then exported from the zone or on goods damaged, destroyed or consumed in the foreign-trade zone.

If your business imports and then assembles parts, you know that components often have a different duty rate than the finished product. The foreign-trade zone allows you to pay the lower of the two rates - either on the parts or on the assembled goods - when your product is entered into U.S. Customs territory.

In addition, a foreign-trade zone can reduce costs associated with the flow of goods into and out of the country. United States quota restrictions do not apply to merchandise admitted to zones. So, goods in foreign-trade zones can be transformed into non-quota products or can be stored duty-free in zones until a quota opens and the goods are entered into the U.S. market.

Finally, a zone-to-zone transfer allows users to transfer merchandise from one zone to another and permits duties to be deferred until the product is removed from the final zone for entry into U.S. Customs territory.

________________________________________

Our Client Testimonials

"On behalf of the Foreign Trade Corporation of Costa Rica (PROCOMER) and the Trade office in Miami, we would like to thank you for the support given for the preparation and logistics of the Trade Mission of Exporters to Central Florida on May 16th thru 19th, 2011.

The support given by Coastal Strategies, and particularly from Mr. Steve Toner, contributed to the satisfaction expressed by the Costa Rican businessmen that participated in this Trade Mission. It is remarkable the quality of contacts made for them with Central Florida Importers and Distributors as well as the productive meetings made during the Costa Rica Trade Mission Reception and event. We expect that these initial contacts and negotiations will be concreted into positive business for both parts.

We do believe that this type of trade events will increase commercial links and fortify business between Costa Rica and Florida, using Tampa as a port of entrance."

Cordially,

Jorge Zamora, General Director

PROCOMER, Foreign Trade Corporation of Costa Rica

Steve Toner (formerly with Coastal Strategies, Inc.) is now with Coldwell Banker Commercial Saunders Real Estate, and Coldwell Banker Commercial Saunders Ralston Dantzler; Providing Real Estate Brokerage and Consulting for Land Developments, Investments, Ranches and Commercial properties.

Please visit us at www.SaundersRealEstate.com.